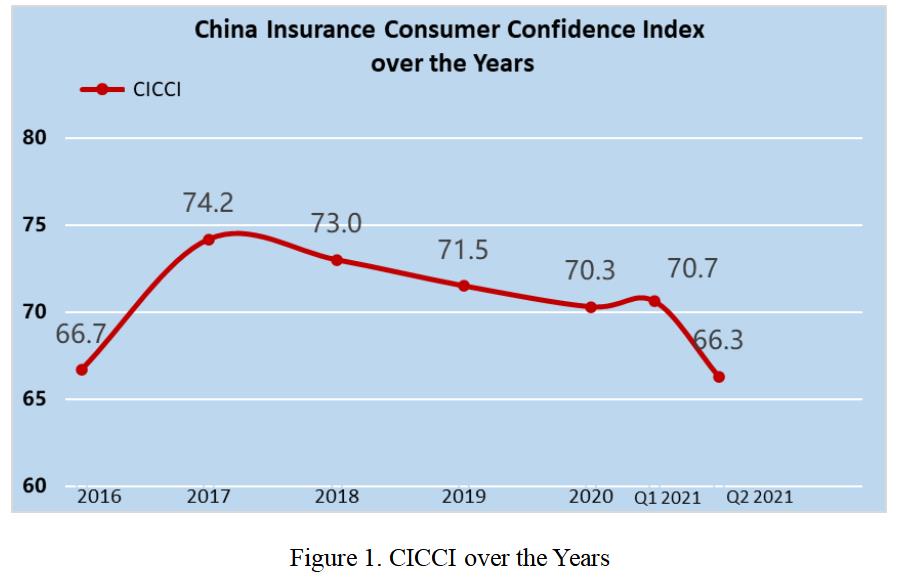

A recent survey shows the China Insurance Consumer Confidence Index (CICCI) in Q2 2021 was 66.3, down 4.4 points from Q1 but still within the range for “high confidence.” By sector, the CICCI of life insurance consumers and property insurance consumers was 65.7 and 66.9, respectively.

I. Changes in CICCI

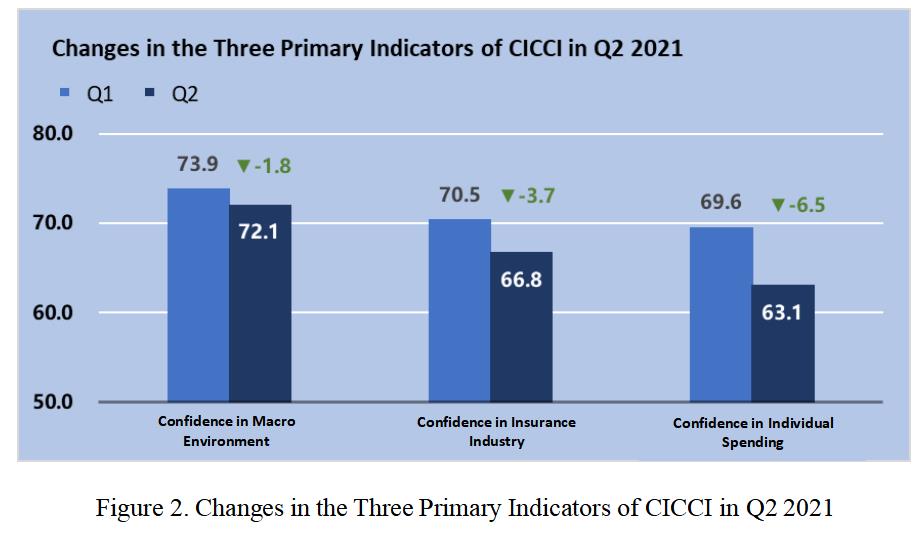

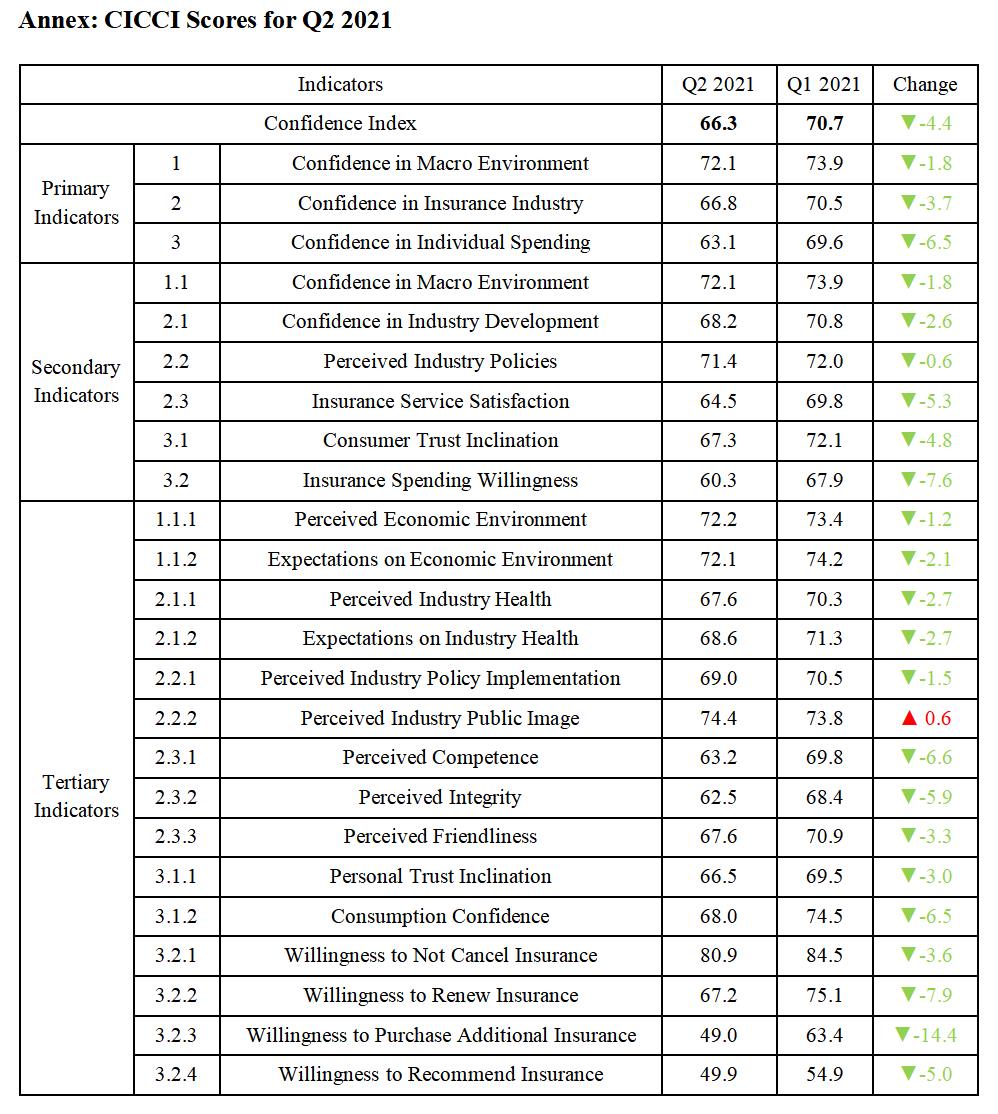

The three primary indicators of the index all fell compared with Q1. This is most notable with confidence in individual spending, which declined from 69.6 to 63.1, followed by confidence in insurance industry, retreating from 70.5 to 66.8. Confidence in macro environment was down from 73.9 to 72.1.

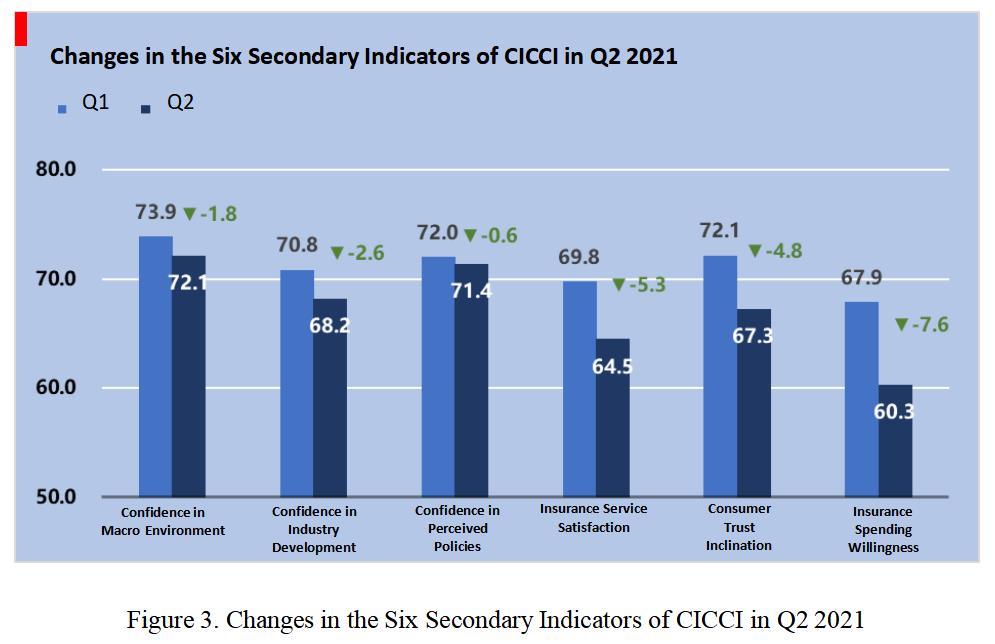

The six secondary indicators also each fell by various degrees. Insurance spending willingness, insurance service satisfaction, and consumer trust inclination showed the sharpest declines, by 7.6, 5.3, and 4.8 points respectively, becoming the main contributors to the overall slump of the CICCI.

II. Trends

A look at the individual indicators reveals the following trends in CICCI in Q2 2021:

First, consumers are maintaining a high level of confidence in the macroeconomy and industry. In the first two quarters of 2021, confidence in macro environment was 73.9 and 72.1 and confidence in insurance industry was 70.5 and 66.8. Although both have declined somewhat, they still stayed in the “high confidence” interval of (65, 80], indicating consumers’ continuing confidence in the macroeconomy and the insurance industry.

Second, consumers’ willingness to purchase additional policies fell slightly. Consumption confidence, one of the constituent factors of the two secondary indicators that registered above-average decline (i.e., consumer trust inclination and insurance spending willingness), dropped variously by 6.5 to 68.0 points, suggesting that consumers were less optimistic about their future incomes. Willingness to purchase additional policy also lost 14.4 to 49.0 points, reaching the “below-average confidence” territory of (35, 50] and showing consumers were little motivated to purchase additional insurance.

Third, consumers became less satisfied with insurance services. The three components of the insurance service satisfaction score—perceived competence, perceived integrity, and perceived friendliness—dropped by 6.6, 5.9, and 3.3 points, respectively. In particular, perceived competence and perceived integrity slipped into the “average confidence” region of (50, 65], hinting that insurers will need to work harder to meet consumer expectations.

Lastly, insurance consumers’ perception of the industry, i.e., the industry’s public image, went up by 0.6 compared with Q1, finishing above 70 in both of the first two quarters of 2021. “Industry public image” measures whether consumers feel the insurance industry has offered them protection against risks. A stable score shows that consumers were feeling a constant level of protection from the industry.

III. Analysis and Suggestions

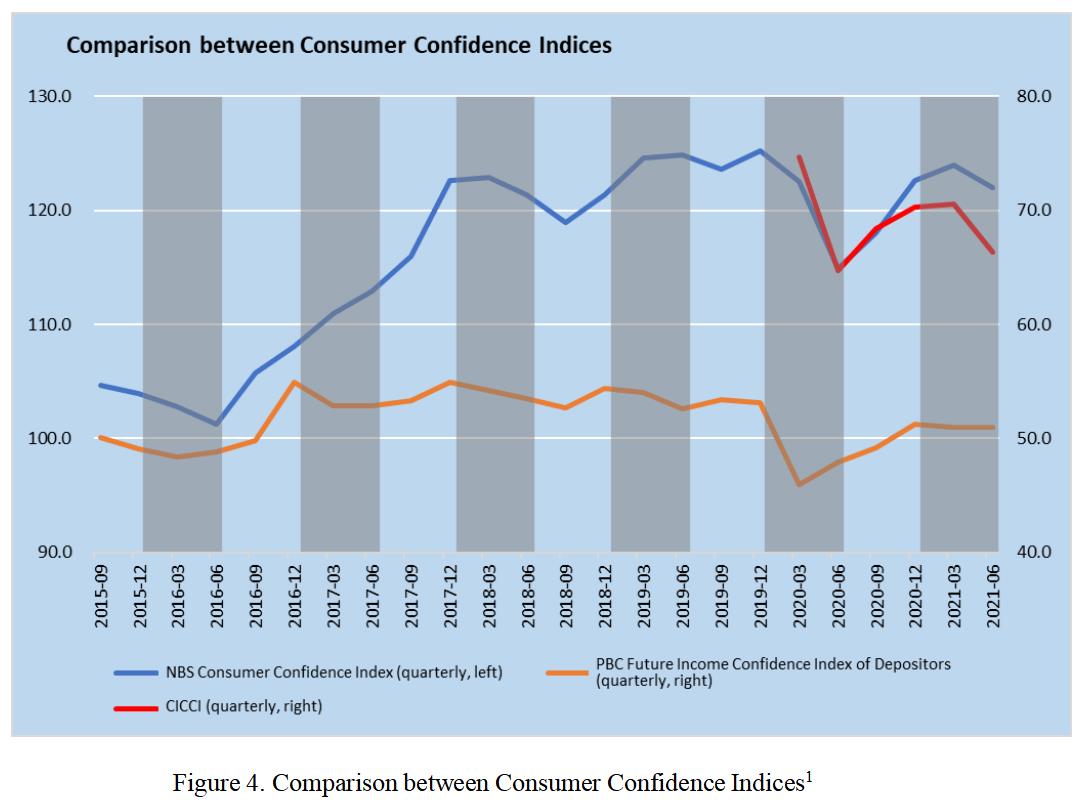

First, the fall in CICCI was primarily driven by reduced confidence in individual spending. Historical data show that CICCI in Q2 2021 was above the Q2 2020 level (64.7) and somewhat below the Q1 2021 level (70.7). Due to factors including the pandemic, in Q2 consumers developed an increasing concern for future income and a growing distrust in insurance salespersons, leading to falling scores in consumption confidence and personal trust inclination, which in turn lowered the overall consumer confidence score. As shown in Figure 4, CICCI substantially tracked the movements of the Consumer Confidence Index published by the National Bureau of Statistics (NBS). The Future Income Confidence Index of Depositors published the People’s Bank of China (PBC) also remained at the 50th percentile level, corroborating with insurance consumers’ concern for their future spending power. Because CICCI is a leading indicator that may not as yet reflect the full extent of the decline in consumer income, changes in consumer income level and their impact on the industry should be closely monitored, analyzed, and calculated.

Second, data analysis reveals that among the sub-indicators that make up “confidence in individual spending,” changes in the willingness to recommend insurance affect consumers’ perception of insurers’ competence, which in turn affects their willingness to renew insurance and purchase additional insurance. In Q2 2021, “willingness to recommend” fell 5.0 points from Q1, “perceived competence” by 6.6 points, “willingness to renew insurance” by 7.9 points, and “willingness to purchase additional insurance” by 14.4 points.

In the first half of 2021, insurers’ net premium written was RMB 2.7 trillion, up 4.2% year-on-year; 22.1 billion new policies were written, down 7.4% year-on-year. In view of the slowing growth in premium income and significant decline in willingness to recommend insurance and to purchase additional policies, the industry should be on high alert for shift in consumers’ insurance needs and anticipate a declining personal willingness to spend. An insurer can improve its service capacity and product offerings to influence consumers’ perception of its capabilities. The industry is recommended to adhere to a people-centric service philosophy by providing consumer-relevant products and services and strengthening the training of its sales force, in order to raise consumers’ perception of its capabilities and, therefore, their willingness to renew and purchase additional policies.

This is the fifth year for CICCI since its introduction in 2016. The frequency of the survey-compilation-publication cycle has been increased from annually to quarterly since 2020. With this change, we hope to gather more data, better understand how insurance consumer confidence affects the industry, and promote industry growth through the forward-looking nature of the index and the accuracy of its observations and measurements. We will continue to dedicate ourselves to the surveys and publication of CICCI, to make it a more effective tool for the market.

Notes on the Compilation of CICCI:

China Insurance Consumer Confidence Index (CICCI) survey covers 18 provinces, autonomous regions, and municipalities in Northeast, North, East, South, Central, Northwest, and Southwest China. These regions account for more than 90% of the national net premium written.

This round of survey uses stratified random sampling to collect 1,071 valid samples for inclusion in the index, comprising 531 from the life insurance segment and 540 from the property insurance segment. Stratified sampling is implemented through an AI- and big data-powered call system that selects and dials mobile numbers without human intervention. After a consumer answers the phone call and confirms his willingness to participate in the survey, the system will automatically send him a text message containing a link to the online survey form. This implementation ensures both consumer privacy and first-hand access to feedback.

CICCI gives a value from 0 to 100, 50 being the neutral result. A score higher than 50 indicates optimism, i.e., a larger proportion of insurance consumers is optimistic rather than pessimistic. The higher the score, the stronger the consumer confidence. Score ranges have the following meanings:

(85, 100]: Very high confidence

(65, 85]: High confidence

(50, 65]: Average confidence

(35, 50]: Below-average confidence

(15, 35]: Low confidence

(0, 15]: No confidence