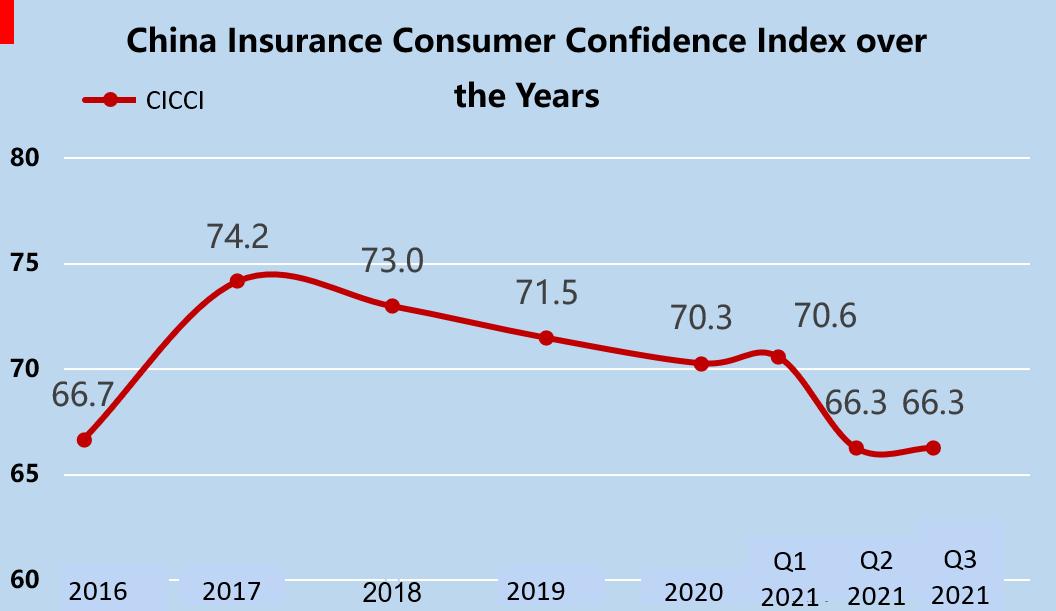

A recent survey shows the China Insurance Consumer Confidence Index (CICCI) in Q3 2021 was 66.3, unchanged from Q2 and still within the range for “high confidence.” By sector, the CICCI of life insurance consumers and property insurance consumers was 66.0 and 66.7, respectively.

Figure 1. CICCI over the Years

I. Changes and Trends in CICCI Indicators

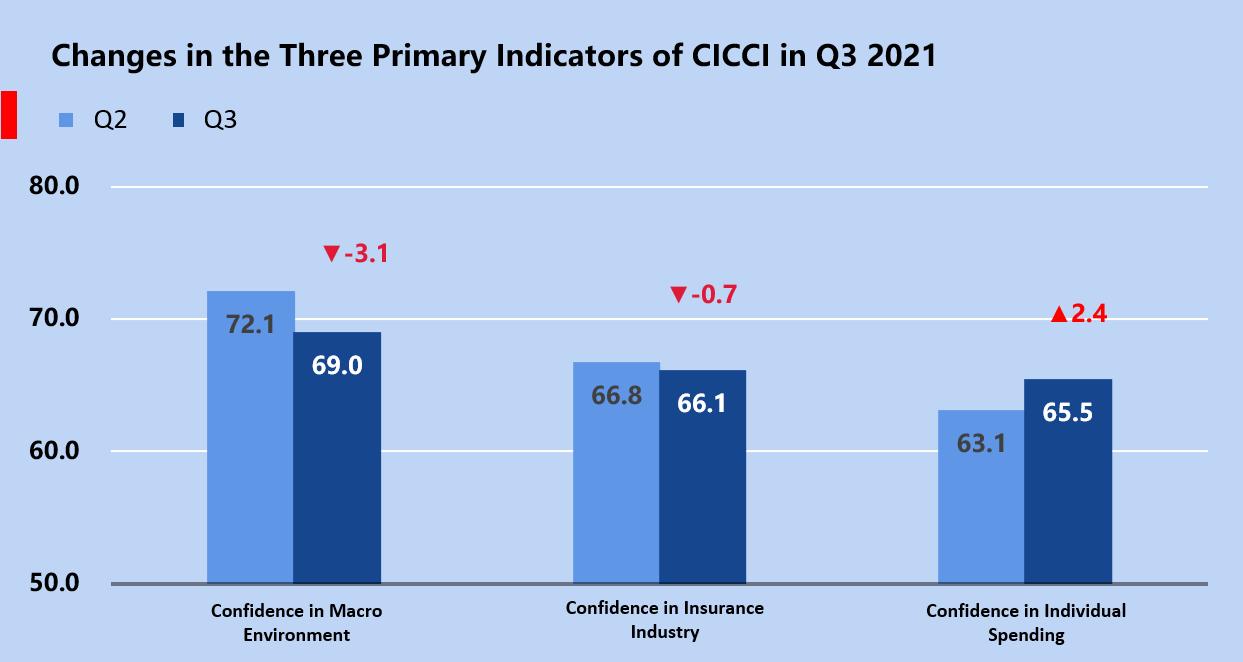

The three primary indicators of the index showed diverging trends from the Q2 levels. Confidence in individual spending rebounded 2.4 from 63.1 to 65.5; confidence in insurance industry retreated by 0.7 from 66.8 to 66.1; and confidence in macro environment diminished 3.1 from 72.1 to 69.0.

Figure 2. Changes in the Three Primary Indicators of CICCI in Q3 2021

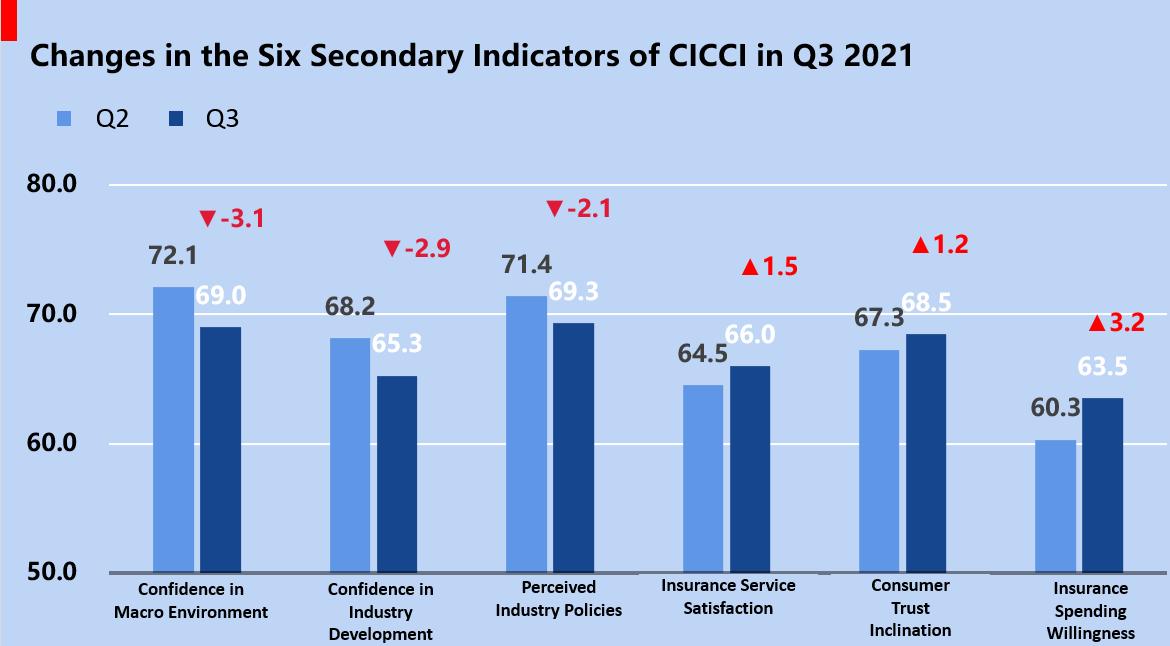

The six secondary indicators were evenly split in direction of movement. Insurance service satisfaction, consumer trust inclination, and insurance spending willingness gained 1.5, 1.2, and 3.2 points respectively, but confidence in macro environment, confidence in industry development, and perceived industry policies were down 3.1, 2.9, and 2.1 points.

Figure 3. Changes in the Six Secondary Indicators of CICCI in Q3 2021

A look at the individual indicators reveals the following trends in CICCI in Q3 2021:

First, insurance consumer confidence is overall stable as the Q3 level remained unchanged from Q2. By sector, confidence level of life insurance consumers gained 0.4 points to 66.0, but that of property insurance consumers fell 0.2 to 66.7. Both indicators are above 66.0 and fall within the (65, 85] range for “high confidence,” indicating a generally strong confidence level among insurance consumers. Of the three primary indicators, the uptick in confidence in individual spending was the primary reason for an overall stable CICCI, while downward trends in confidence in insurance industry and confidence in macro environment held back the recovery of CICCI.

Second, consumer trust inclination and insurance spending willingness, constituent secondary indicators of the primary indicator “confidence in individual spending,” registered a 1.2 and 3.2point increase, respectively, becoming major contributors to the rallying primary indicator. Among the tertiary indicators, consumption confidence rose 3.3 points to 71.3; personal trust inclination retreated 1.2 points to 65.3; willingness to not cancel insurance increased 3.3 points to 84.2, all staying in the “high confidence” region of (65, 85]. Willingness to renew was up by 2.6 points to 69.8; willingness to purchase additional policies and willingness to recommend policies bounced back to 53.7 and 52.7, returning to the “average confidence” region of (50, 65].

Third, of the three components of confidence in insurance industry, two finished below the Q2 level and one above. This primary indicator showed a minor decline due to the lower confidence in industry development and confidence in perceived industry policies, which were counteracted by gains in insurance service satisfaction. In particular, consumers were less optimistic about both the current and future performance of the insurance industry, and perceived policy implementation and perceived public image also lost ground. Insurance service satisfaction scored 66.0 points, putting it 1.5 higher than in Q2 and back to the “high confidence” region of (65, 85]. Its three components—perceived integrity, perceived competence, and perceived friendliness—climbed 2.3, 1.6, and 0.6 points, respectively.

Lastly, confidence in macro environment stayed in the “high confidence” region of (65, 85] despite scoring lower than before. Its two constituent secondary indicators—confidence in perceived economic environment and economic environment forecast—fell 4.1 and 2.4 points to 68.1 and 69.7, respectively, but still within the (65, 85] region for “high confidence.”

II. Comments and Suggestions

First, recovery in the confidence in individual spending provides an enabling environment for marketing and insurance literacy activities. The industry should closely monitor changes in consumer needs to offer optimized and targeted products and services. Insurers should also be aware that the downward trend in personal trust inclination hasn’t been halted. Increasing consumer satisfaction relies on creating a trusted sales team. Hence, the industry would stand to benefit by enhancing service capacity and building a more professional and friendly sales team. This would help improve the industry’s public image and therefore consumer confidence in the industry.

Second, with confidence in macro environment and in insurance industry both trending downward in the short term, the industry should closely monitor risk transmission from outside the industry. Historical data show that there is a strong, positive correlation between insurance consumers’ confidence in the macro environment and in the insurance industry. The recent string of natural disasters and extreme weather events has led to increased claims. Localized resurgence of COVID-19, soaring commodity prices, and strained power supplies also affect consumers’ perception of the macro and industry environment. The industry should therefore be highly sensitive to changes in the macro environment and strengthen risk management, restoring consumer confidence through robust, sustainable business performance and prompt, efficient services.

From a broader perspective, CICCI has remained stable in the first three quarters of 2021 and consistently falls within the “high confidence” range. Insurers should continue to track the indicator and, capitalizing on the rebounding confidence in individual spending and implementing a market demand-driven strategy, expand and optimize their product offerings, strengthen risk control, and enhance the professionalism and service quality of their sales teams, in order to help people build a better life.

Notes on the Compilation of CICCI:

China Insurance Consumer Confidence Index (CICCI) survey covers 18 provinces, autonomous regions, and municipalities in Northeast, North, East, South, Central, Northwest, and Southwest China. These regions account for more than 90% of the national net premium written.

This round of survey uses a combination of two-phase stratified sampling, probability proportional to size (PPS) sampling, and random telephone sampling to collect 1,071 valid responses for inclusion in the index, comprising 531 from the life insurance segment and 540 from the property insurance segment. The online survey is completed with a big data-driven sampling frame and an AI-powered call system without human intervention. After a consumer answers the phone call and confirms his willingness to participate, the system will automatically send him a text message containing a link to the online survey form. This implementation ensures both consumer privacy and first-hand access to feedback.

CICCI gives a value from 0 to 100, 50 being the neutral result. A score higher than 50 indicates optimism, i.e., a larger proportion of insurance consumers is optimistic rather than pessimistic. The higher the score, the stronger the consumer confidence. Score ranges have the following meanings:

(85, 100]: Very high confidence

(65, 85]: High confidence

(50, 65]: Average confidence

(35, 50]: Below-average confidence

(15, 35]: Low confidence

(0, 15]: No confidence