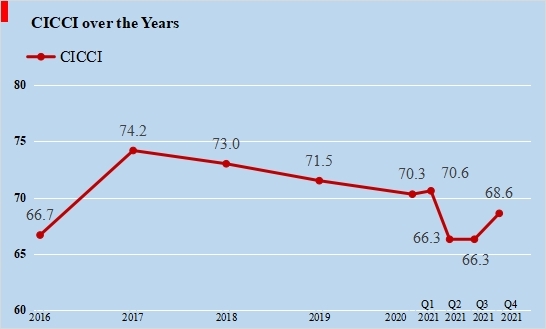

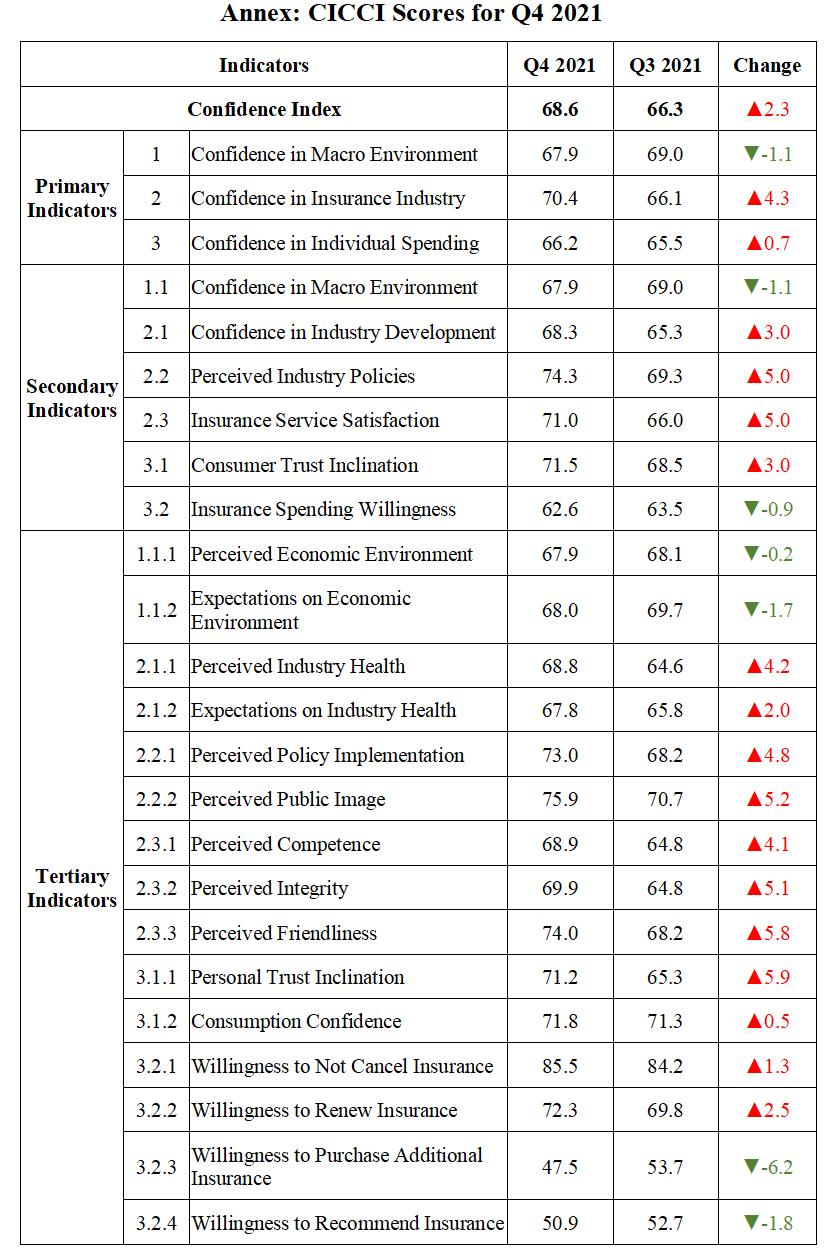

A recent survey shows the China Insurance Consumer Confidence Index (CICCI) in Q4 2021 was 68.6, up 2.3 from Q3 and still within the range for “high confidence.” By sector, the CICCI of life insurance consumers and property insurance consumers was 68.4 and 68.7, respectively. The CICCI across the year features a rebound in the second half of 2021.

Figure 1. CICCI over the Years

I. Changes and Trends in CICCI Indicators

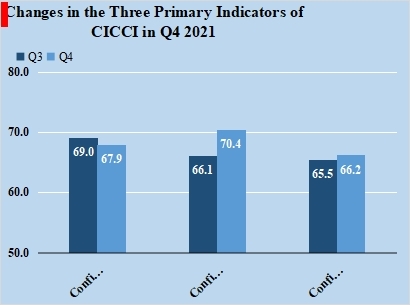

Of the three primary indicators of CICCI, two finished above the Q3 levels and one below. Confidence in insurance industry gained 4.3 points from 66.1 to 70.4, confidence in individual spending improved 0.7 points from 65.5 to 66.2; and confidence in macro environment diminished 1.1 points from 69.0 to 67.9.

Figure 2. Changes in the Three Primary Indicators of CICCI in Q4 2021

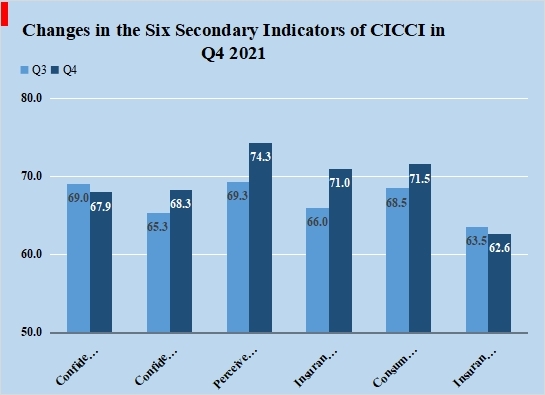

The six secondary indicators were split in direction of movement. Confidence in industry development, perceived industry policies, insurance service satisfaction and consumer trust inclination gained 3.0, 5.0, 5.0 and 3.0 points respectively, while confidence in macro environment and insurance spending willingness lost 1.1 and 0.9 points.

Figure 3. Changes in the Six Secondary Indicators of CICCI in Q4 2021

A look at the individual indicators reveals the following trends in CICCI in Q4 2021:

First, CICCI has gained ground from Q3. Of the three primary indicators, the uptick in confidence in insurance industry and confidence in individual spending was the main contributor to a stronger CICCI, while the downward trend in confidence in macro environment held back its recovery. By sector, the confidence level of life insurance consumers climbed 2.4 points to 68.4, and that of property insurance consumers rose 2.0 points to 68.7. Both indicators fall within the (65, 85] range for “high confidence”.

Second, insurance service satisfaction, perceived industry policies and confidence in industry development, constituent secondary indicators of the primary indicator “confidence in individual spending”, were improved over Q3. Insurance service satisfaction continued its rising momentum in Q3 and scored the year’s highest 71.0. Its three tertiary indicators—perceived friendliness, perceived integrity and perceived competence—climbed 5.8, 5.1 and 4.1 points, respectively. Perceived industry policies, driven by the stronger perceived policy implementation (up 4.8) and perceived public image (up 5.2), rebounded in Q4 to 74.3, the highest of 2021. Confidence in industry development has returned to the “high confidence” region of (65, 85] as its tertiary indicators—perceived industry health and expectations on industry health—registered 4.2- and 2.0-increase respectively.

Third, consumer trust inclination and insurance spending willingness, which constitute confidence in individual spending, moved upward and downward respectively. Of the components of the secondary indicator “consumer trust inclination”, personal trust inclination gained 5.9 points to 71.2, and consumption confidence rose 0.5 point to 71.8. Of the components of “insurance spending willingness”, willingness to not cancel insurance increased 1.3 points to the year’s highest 85.5, falling in the “very high confidence” range of (85, 100]; willingness to renew insurance climbed 2.5 points to 72.3; but willingness to purchase additional insurance and willingness to recommend insurance lost 6.2 and 1.8 points, respectively.

Fourth, confidence in macro environment remained in the “high confidence” region of (65, 85] despite a lower score. Both of its territory indicators—confidence in macro environment and expectations on economic environment—were down 0.2 and 1.7 points, respectively, but still in the (65, 85] range for “high confidence”.

II. Comments and Suggestions

First, all three secondary indicators of “confidence in insurance industry” have achieved higher scores, indicating more consumer optimism in the insurance industry, which helps improve the industry’s public image. The industry also sought less burden on consumers by improving risk protection. According to the China Banking and Insurance Regulatory Commission, in the first ten months of 2021, China’s social insurance amounted to RMB 9,411.43 trillion, up 29.26% over the previous year; and insurance claims and payments totaled RMB 1.27 trillion, with a YoY increase of 16.52%. In particular, as of the end of October 2021, a comprehensive reform of the auto insurance had cut the premiums by 21%, benefitting 87% of the consumers. Insurers should, in alignment with the “people-centered” philosophy of development, leverage on the upward trend in confidence in insurance industry to provide more diversified risk protections and improve consumers’ sense of gain.

Second, the recovery in confidence in individual spending creates an enabling environment for marketing and more convenient and better insurance services to customers. In Q4, personal trust inclination and willingness to not cancel insurance peaked the year, and consumption confidence and willingness to renew insurance continued their uptrend. These represent consumers’ increased trust in insurance salespersons and stronger willingness to maintain their insurances. Insurers should response to consumers’ trust by building the professional capabilities of their sales teams to better meet customer needs. Insurers should also be aware that willingness to recommend insurance and willingness to purchase additional insurance were still in the “average confidence” or “below-average confidence” range. The survey reveals that, for life and property insurance consumers who have no intention to purchase additional insurance in the next six months, “I have sufficient insurance coverage and there is no need for additional insurance”, “There is no spare money” and “There is no suitable product” are the top reasons. For consumers who plan to purchase additional life insurance in the next 6 months, health insurance, accident insurance and life insurance are preferred; and for those intending to purchase additional property insurance in the next 6 months, auto insurance, account security insurance and home property insurance are on the top of their list. The willingness to purchase additional insurance remained strong among married consumers with children and consumers with an insurance history of less than five years despite a general decline. Given the above, insurers should optimize and customize products and services to customer needs, to stimulate their willingness to purchase additional insurance.

Third, the confidence in macro environment is still trending downward, which calls for close attention to economic changes and trends. Internally, China’s economy is challenged by demand contraction, supply shocks and weaker expectations. Externally, the increasingly complex and severe international environment has posted growing uncertainties. The positive side is that China has the world’s fastest-growing economy which provides effective guarantee to people’s wellbeing. Ensuring stability in employment, financial operations, foreign trade, foreign investment, domestic investment, and expectations and security in job, basic living needs, operations of market entities, food and energy supply, stable industrial operation and supply chain, and the normal functioning of primary-level governments, China will maintain stability of the overall society by pursuing improvement in the public wellbeing, sustained macro-economic growth, and health performance of economic indicators. In such a context, insurers should align their operation and development strategies with the economic trends and the central government’s decisions and arrangements, to achieve resilient high-quality development.

From a broader perspective, the CICCI remained stable across 2021 and stayed in the “high confidence” range. Insurers should continue to track this index and, capitalizing on the rebounding confidence in insurance industry and individual spending, improve service quality and the industry’s public image and provide products and services in a customized, honest, and professional manner to meet consumer expectations and needs for a better life.

Notes on the Compilation of CICCI:

China Insurance Consumer Confidence Index (CICCI) survey covers 18 provinces, autonomous regions, and municipalities in Northeast, North, East, South, Central, Northwest, and Southwest China. These regions account for more than 90% of the national net premium written.

This round of survey uses a combination of two-phase stratified sampling, probability proportional to size (PPS) sampling, and random telephone sampling to collect 1,071 valid responses for inclusion in the index, comprising 531 from the life insurance segment and 540 from the property insurance segment. The online survey is completed with a big data-driven sampling frame and an AI-powered call system without human intervention. After a consumer answers the phone call and confirms his willingness to participate, the system will automatically send him a text message containing a link to the online survey form. This implementation ensures both consumer privacy and first-hand access to feedback.

CICCI gives a value from the [0, 100] range, 50 being the neutral result. A score higher than 50 indicates optimism, i.e., a larger proportion of insurance consumers is optimistic rather than pessimistic. The higher the score, the stronger the consumer confidence. Score ranges have the following meanings:

(85, 100]: Very high confidence

(65, 85]: High confidence

(50, 65]: Average confidence

(35, 50]: Below-average confidence

(15, 35]: Low confidence

(0, 15]: No confidence