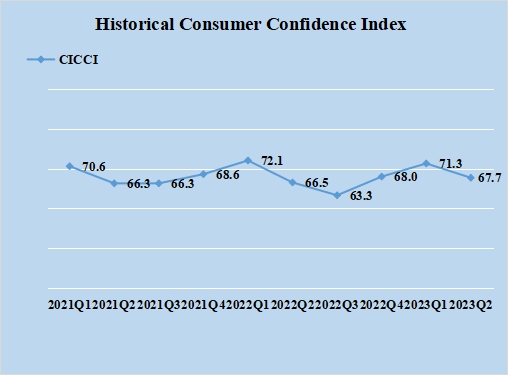

The China Insurance Consumer Confidence Index (CICCI) in Q2 2023 was 67.7, representing a drop of 3.6 from Q1 2023 and up 1.2 from Q2 2022 and being in the range of “high confidence” (65, 85]. Since this year, CICCI has been in the range of high confidence. Compared with the same period of 2021 and 2022, it has rebounded in Q2, and has fallen behind from Q1 2023. The insurance consumer confidence has shown a development trend of adjustment and recovery.

![]()

Figure 1. CICCI since 2021

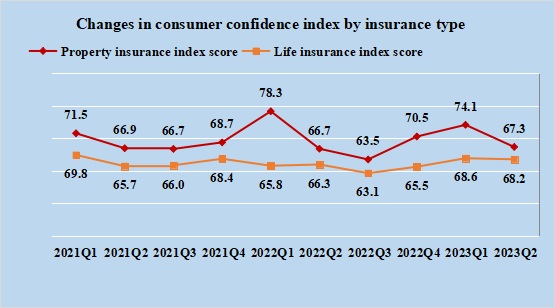

In terms of insurance types, the consumer confidence index of life insurance and property insurance in Q2 2023 was 68.2 and 67.3 respectively, both of which were in the range of “high-confidence”. The drop of the property insurance consumer confidence index from Q1 2023 was slightly higher than that of life insurance.

Figure 2. Changes in Life Insurance Consumer Confidence Index and Property Insurance Consumer Confidence Index

In Q2 2023, the life insurance consumer confidence index was 68.2, being in the range of “high confidence”, down 0.4 from Q1 2023 and up 1.9 from Q2 2022. Indicators showed the following trends:

First, among the three primary indicators, one went up, one went down and one remained largely unchanged in Q2 2023 from Q1 2023. Macro environment confidence has slightly dropped, confidence in insurance industry has increased, and confidence in individual spending has maintained stable, with confidence in insurance industry and confidence in individual spending staying within the range of “high confidence”. The three primary indicators were all higher than those in Q2 2022.

Second, three went up and three down among the six secondary indicators in Q2 2023 from Q1 2023. Confidence in industry development, insurance service satisfaction and consumer trust willingness were the three indicators that grew stronger than last quarter, of which consumer trust willingness gained the greatest increase. Confidence in macro environment, perceived industry policies and insurance spending willingness were the three indicators that dropped quarter on quarter. Confidence in industry development, perceived industry policies, insurance service satisfaction, and consumer trust willingness were the four secondary indicators being in the range of “high confidence”. Except insurance service satisfaction, the other five secondary indicators were all higher than those in Q2 2022.

The life insurance consumer confidence index in Q2 2023 was higher than the same period of 2021 and 2022, and the consumption environment of life insurance showed a positive and upward trend. Among them, consumer trust willingness increased by 4.0 to 71.5 from Q1 2023, which was also the highest level since Q2 2021. Confidence in industry development and industry service satisfaction have rebounded for three consecutive quarters. Perception in industry policy was higher than that in Q2 2022, showing that consumers’ expectations for the development of life insurance industry have gradually improved, which was conducive to the continuous transformation and upgrade of life insurance industry. Although consumers’ expectations of the economic environment and insurance spending willingness weakened qoq, they were close to the level of the same period in previous years and remained stable overall. As the Q2 survey showed, 59.1% of respondents would purchase additional insurance in the next six months, down 6.1 percentage points from Q1 2023. Among them, 63.7% would buy health insurance, (up 22.8 percentage points from Q1 2023); and 59.9% would buy accident insurance, (up 10.9 percentage points from Q1 2023) and 39.2% would buy life insurance, (up 2.3 percentage points from Q1 2023).

At present, the life insurance market is gradually picking up, and the predetermined interest rates of some life insurance products are facing adjustment, which has further stimulated the consumption willingness of insurance consumers. It is suggested that industry market subjects shall seize the opportunity that consumers’ perception of the development of life insurance industry is gradually improving, constantly improve the risk protection function of insurance products, accurately meet consumers’ risk protection demand for healthcare, pension and wealth security, build an inclusive insurance product system, focus on increasing the protection of risk groups such as the elderly, female, children and new citizens, give full play to the role of insurance economy as a “shock absorber” and social “stabilizer”, and promote the steady recovery of consumer market of life insurance.

In Q2 2023, the property insurance consumer confidence index was 67.3, being within the range of “high confidence”, down 6.8 from Q1 2023 and up 0.6 from Q2 2022. Indicators showed the following trends:

Three primary indicators and six secondary indicators all dropped from Q1 2023. Among the three primary indicators, confidence in insurance industry and confidence in individual spending were being within the range of “high confidence” and confidence in macro environment was being within the range of “average confidence”. Confidence in macro environment and confidence in individual spending were all higher than those in Q2 2022. Among the six secondary indicators, confidence in industry development, perceived industry policies, insurance service satisfaction, consumer trust willingness and insurance spending willingness were being in the range of “high confidence”. Confidence in macro environment and insurance spending willingness were both higher than those in Q2 2022.

In Q2, the consumer confidence index of property insurance dropped from Q1 2023, in line with the change trend of the index in Q2 of previous year. The qoq drop was narrower than that in the same period of last year, and the index was still higher than that in 2021 and 2022, especially that confidence in macro environment and insurance spending willingness were higher than those in the same period of 2022, indicating that the consumption environment of property insurance still maintained a warming trend. Perceived industry policies, confidence in industry development, and insurance service satisfaction of the consumer have weakened, but still be within the range of “high confidence”. As the Q2 survey showed, 77.8% of respondents would purchase additional insurance in the next six months, down 1.5 percentage points from Q1 2023. Among them, 58.3% would buy auto insurance, (down 3.2 percentage points from Q1 2023); and 41.9% would buy account security insurance, (up 9.9 percentage points from Q1 2023) and 29% would buy home property insurance, (down 5.1 percentage points from Q1 2023).

At present, confidence in macro environment and confidence in insurance industry of property insurance consumers still need to be improved, and the foundation of consumer confidence recovery needs to be consolidated. Recently, the relevant state departments have formulated and introduced policies to restore and expand consumption, so as to stabilize automobile and household consumption. With the arrival of the consumption season of summer holiday, the consumer demand for leisure shopping and travelling will be further released, which is conducive to the property insurance consumer market to continue to maintain a warming momentum. It is suggested that industry subjects shall pay close attention to consumer demand trends, strengthen risk reduction service management, and innovate product supply covering the risk protection needs of consumers in different consumption scenarios, such as travelling and tourism, home property protection and payment security, so as to meet the new expectations of consumers for risk protection services.

In Q2 2023, consumer confidence index of property insurance and life insurance were both within the range of “high confidence” and higher than the level of the same period in previous years. Consumer confidence index of property insurance was lower than that of life insurance for the first time. From the historical data, seasonal fluctuation of consumer confidence index of property insurance was relatively high. The differences reflected the different feelings of different types of insurance consumers on the current market. Overall, insurance consumer confidence continued to adjust and recover. It is suggested that industry subjects shall seize the critical period of recovering and expanding effective demand, continuously optimize and improve insurance services, continuously implement insurance policies for the benefit of the general public, consolidate the foundation of recovering insurance consumption, improve the service quality and efficiency of the industry, and promote the high-quality development of the industry.

Notes on the Compilation of CICCI:

China Insurance Consumer Confidence Index (CICCI) survey covers 18 provinces, autonomous regions, and municipalities in Northeast, North, East, South, Central, Northwest, and Southwest China. These regions account for more than 90% of the national net premium written.

This round of survey uses a combination of two-phase stratified sampling, probability proportional to size (PPS) sampling, and random telephone sampling to collect 1,071 valid responses for inclusion in the index, comprising 531 from the life insurance segment and 540 from the property insurance segment. The online survey is completed with a big data-driven sampling frame and an AI-powered call system without human intervention. After a consumer answers the phone call and confirms his/her willingness to participate, the system will automatically send him/her a text message containing a link to the online survey form. This implementation ensures both consumer privacy and first-hand access to feedback.

CICCI gives a value from the [0, 100] range, 50 being the neutral result. A score higher than 50 indicates optimism, i.e., a larger proportion of insurance consumers is optimistic rather than pessimistic. The higher the score, the stronger the consumer confidence. Score ranges have the following meanings: (85, 100]: Very high confidence; (65, 85]: High confidence; (50, 65]: Average confidence; (35, 50]: Below-average confidence; (15, 35]: Low confidence; and [0, 15]: No confidence