Business Scope

1. CISFC engages in the collection, management and employment of CISF;

2. CISFC monitors risks in the insurance industry, and advances regulatory resolution suggestions to CIRC when targeting at any material risk within the operation and management of insurance companies, which may endanger policyholders and the whole industry;

3. CISFC provides bailout for policyholders, policy transferee companies, other individuals and institutions, or participates in risk resolution of the insurance industry;

4. CISFC participates in the liquidation of an insurance company when it is dissolved or declared bankruptcy according to the law;

5. CISFC takes over and disposes of liquidation assets; and

6. CISFC runs other businesses approved by the State Council.

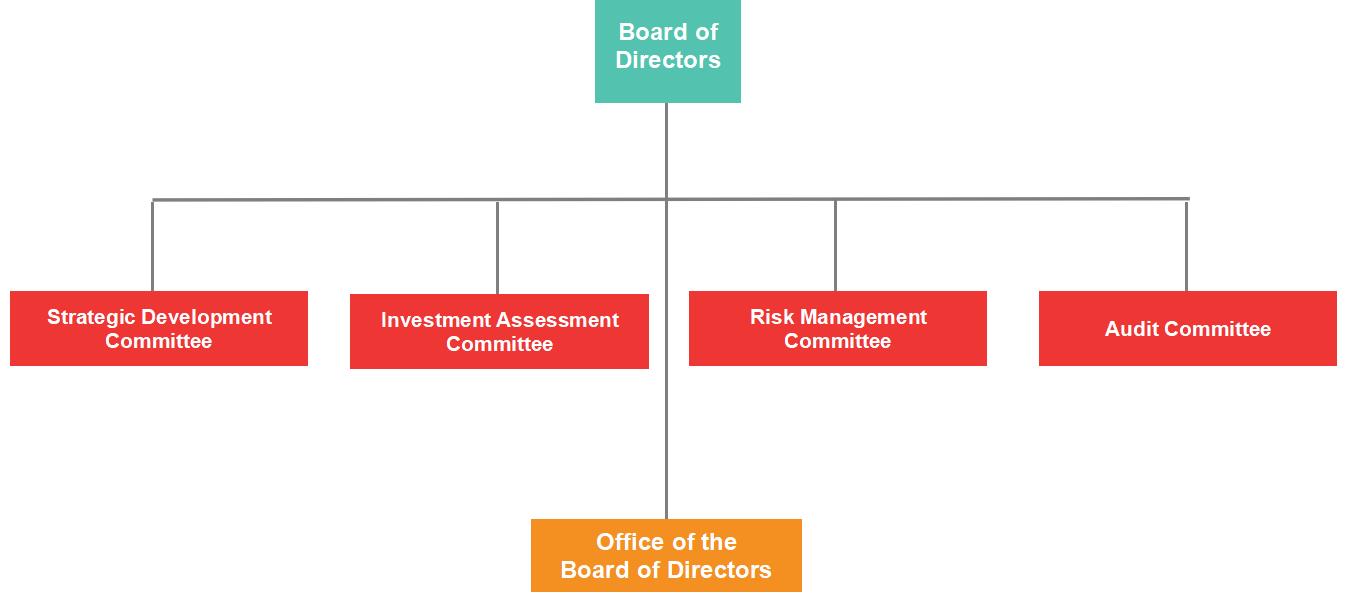

Board of Directors

The Company has built up its Board of Directors. The First Board of Directors was composed of nine directors, the Second Board eight directors, and the Third Board nine directors, all of whom are from regulatory authorities, related ministries/commissions, trade organizations, and insurance companies.

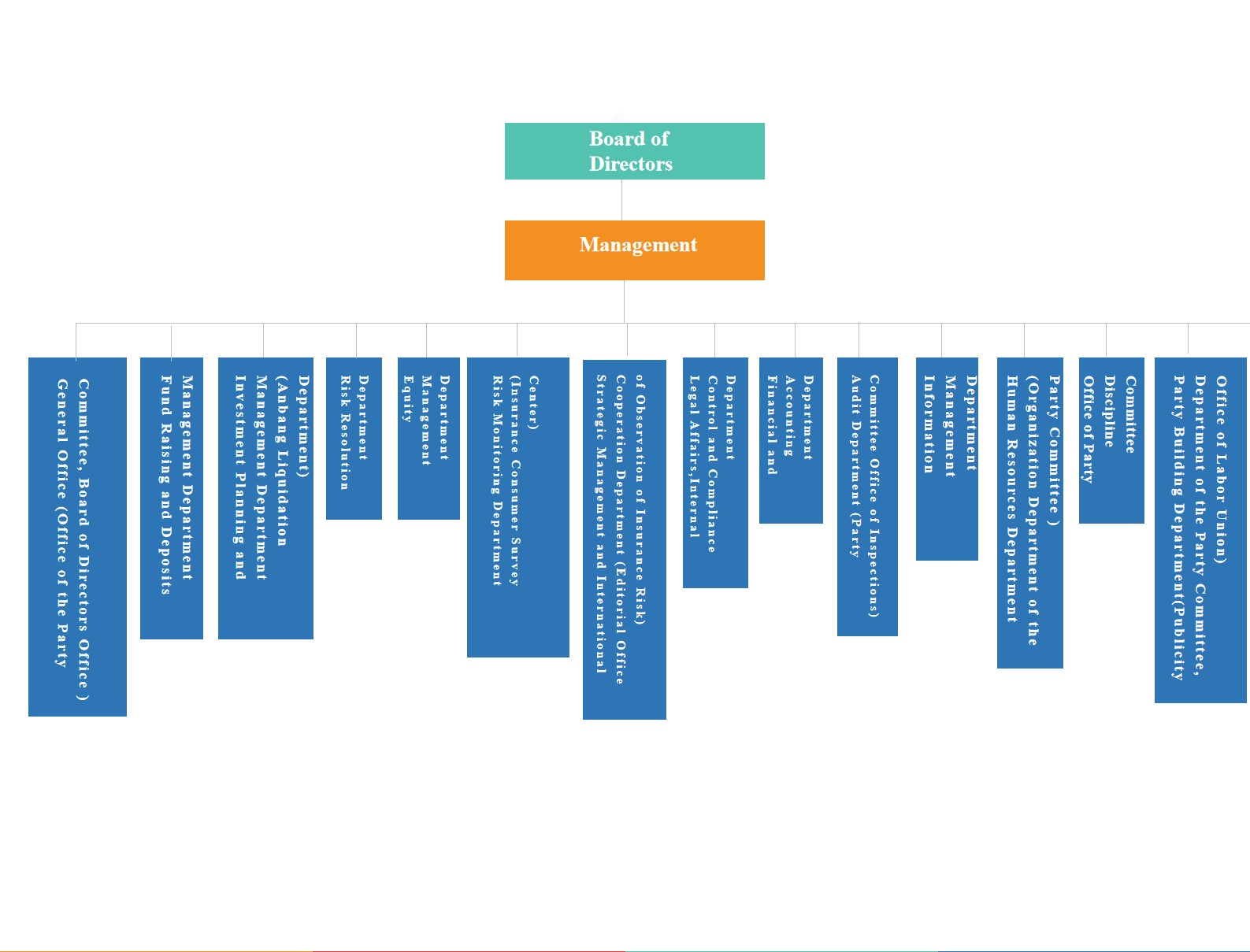

Organizational structure

At present, CISFC consists of 14 internal offices and departments:General Office (Office of the Party Committee, Board of Directors Office );Fund Raising and Deposits Management Department;Investment Planning and Management Department (Anbang Liquidation Department);Risk Resolution Department;Equity Management Department;Risk Monitoring Department (Insurance Consumer Survey Center);Strategic Management and International Cooperation Department (Editorial Office of Observation of Insurance Risk);Legal Affairs,Internal Control and Compliance Department;Financial and Accounting Department;Audit Department (Party Committee Office of Inspections);Information Management Department;Human Resources Department (Organization Department of the Party Committee );Office of Party Discipline Committee;Party Building Department(Publicity Department of the Party Committee, Office of Labor Union).

Organizational Chart