July 12, 2018

In July 2018, China Insurance Security Fund Co., Ltd. (CISFC) issued the Risk Assessment Report of China Insurance Industry in 2018 (“Industry Risk Assessment Report”) in Beijing. The report indicates that in 2017, China’s insurance industry showed the following features: accelerating return to its roots, stable progress and positive development, more effective products in terms of level of protection to the insured, improving service capacity, and generally manageable industry risks, but also warns that there will be significant challenges ahead. By examining seven areas of concern for the industry – liquidity risk, risks in the industry transformation process, operational risk, interest rate risk, credit risk, corporate governance and compliance risk, and reputation risk – the report has provided an in-depth analysis on the risks faced by China’s insurance industry in 2017 and beyond.

CISFC has been compiling and publishing industry risk assessment reports every year since 2015. As the only independent, professional, and yearly report that monitors and evaluates the risks within China’s insurance industry, the Industry Risk Assessment Report provides a methodical look at the state and risks of the industry and serves as a valuable reference material for insurance institutions and the industry as a whole. Its aim is to promote better risk management capabilities within the industry.

1. Report Framework and Features

This year’s Industry Risk Assessment Report is organized into four parts: economic and financial environment, industry operations, industry risk assessment, and expert observations. After reviewing the internal and external environments of China’s insurance industry in 2017, the report gives a comprehensive analysis of the state of the industry and, in particular, highlights the current operational and development risks.

This year’s Industry Risk Assessment Report is distinguished by four features. First, it gives more perceptive viewpoints. By considering the experiences from day-to-day risk monitoring programs, outcomes from CISFC expert committee meetings, and major changes within the year, the report is able to provide a more current and relevant account of the operation and risk profile of the industry in 2017. Second, it offers a more systematic and holistic analysis of policies. A series of policies, regulations, and normative documents were introduced in 2017 to improve market order, regulation and supervision, and the sound operation of the industry. Accordingly, the report systematically and comprehensively examines the major industry policies in 14 areas, including the “1+4” Documents, building of the solvency system, creation of the insurance consumer protection framework, development of the multi-level commercial pension and health insurance system, and stronger responses against market misconducts. Third, more dimensions in data analyses. Drawing on publicly disclosed data, the report has systematically and meticulously summarized the core operational and business indicators of insurers and the insurance industry as well as the supervisory information published by insurance regulators, producing a much richer data analysis. Fourth, experts have taken a more targeted perspective. The editors had chosen the most relevant industry risks as topic of discussion and invited members of the expert committees with corresponding specializations to provide their independent analysis, giving greater depth to the risk assessments in the report.

2. Report Views

(1) Market operations

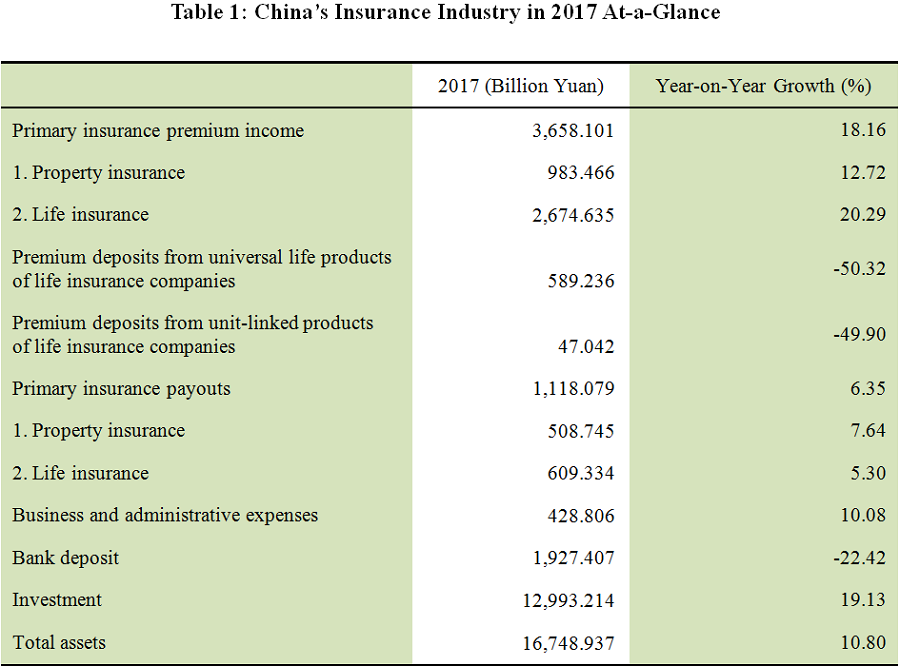

China’s insurance market saw stable progress and positive development in 2017. Premium income on primary insurance grew 18.16% year-on-year to RMB 3.66 trillion; total assets rose to RMB 16.75 trillion and net assets to RMB 1.88 trillion. The level of risk protection also increased rapidly, with the industry providing RMB 4154 trillion of coverage in total, a surge of 75% from the year before and offering greater support to economic and social development. The industry was returning to its roots through continuous adjustment and improvement of business structure; more diversified asset allocation scheme produced a return on investment of 5.77%; and the industry as a whole maintained an adequate solvency level. Additionally, both insurance density and insurance depth steadily increased; the insurance market welcomed a wider range of participants, and consumer protection was stronger than ever. The Insurance Consumer Confidence Index reached 73.7 in 2017, besting the score of 69.2 in 2015 and 71.2 in 2016.

(2) Risk evaluation

While insurance industry risks are generally controllable now and in the foreseeable future, the industry is still in a precarious situation. Externally, uncertainty in risks and tensions, a result of the complex economic and financial environment home and abroad, may materially impact the insurance industry; internally, China’s insurance industry is in a triply delicate period wherein it is at once trying to prevent and mitigate existing risks, alleviate deep-rooted structural tensions, and effectuate difficult transformations of its development models, which will expose the risks in a number of critical areas and key companies. Some of these risks are commonplace and only involve a few companies; some – primarily those that tend to spread across sectors, industries, and markets – will reveal regulatory gaps, loopholes, and shortfalls; some are brought on by the new industry landscape and development; and some are derivative products of industry and regulatory transformations. These are compounded by the deficiencies of the current insurance supervisory system, which is still in the process of recovery and continuous improvement.

The report attempts to examine liquidity risks, transformation-related risks, corporate governance risks and more in the context of evolving and new industry risks. Its observations on the principal risks and challenges confronting China’s insurance industry in 2017 and now can be summarized into seven points:

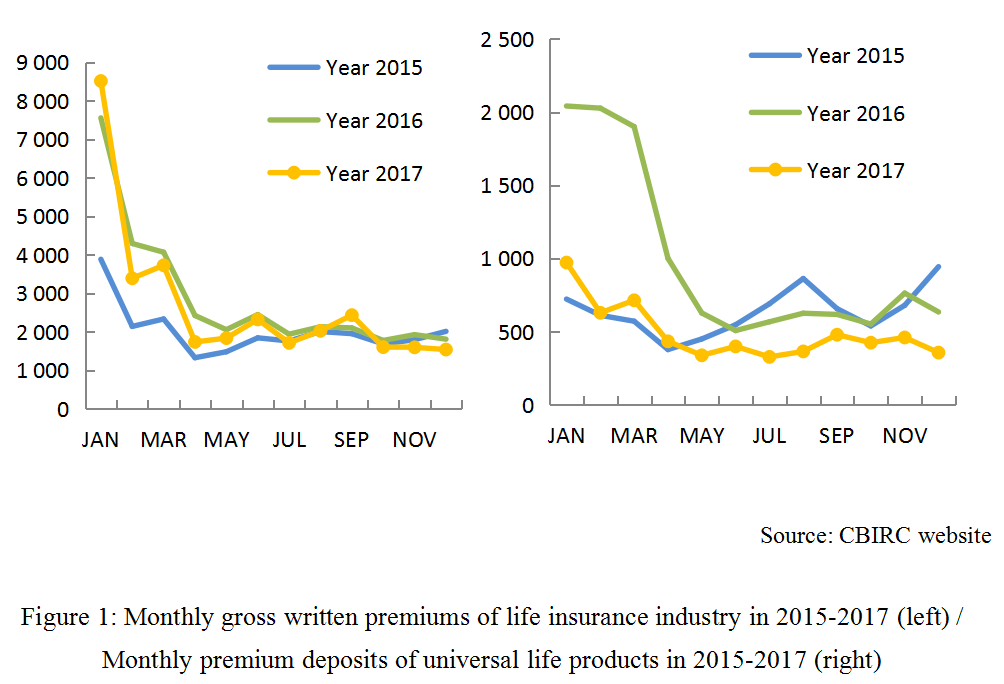

1. Some companies are under significant liquidity pressure. Although overall the industry had a healthy cash flow in 2017, stratification was becoming more pronounced as local liquidity risks began to emerge. For some life insurance companies that underwent structural adjustments to businesses, the resulting declining premium inflow, coupled with surging surrender value and consistently high maturity payments, created a mounting cash outflow problem. Some insurers with excessive reliance on short- to medium-term products also showed a serious asset-liability mismatch which led to severe cash flow pressure. Moreover, some that offered non-life investment products have accumulated a substantial outstanding balance, and will need to watch out for liquidity risks as maturity benefits on those products will need to be paid over a relatively short period.

2. The transformation of life insurance business faces many challenges. First, while sales have been suspended on the main products of some insurers, most small- and medium-sized insurers lack the empirical data and actuarial expertise to develop protection policies and are experiencing significant product development difficulties. Second, suspension of sales of collectively paid reimbursement products through banks and post offices, as well as inadequate marketing skills to sell protection policies, have caused the premium growth rate to plummet; smaller companies will be hard pressed to remedy the lack of sales channels as building the networks to sell to individuals is a long and costly process. Third, lengthening liability duration, scarcity of long-maturity assets, rising minimum capital requirements linked to industry’s overall market risk and insurance risk, as well as a markedly reduced inflow of private capital have caused a sweeping decline in the solvency indicators of life insurance companies. Fourth, along with product switches, insurers are facing longer and more complex risks, creating higher requirements on their risk management, investment, and operational capabilities.

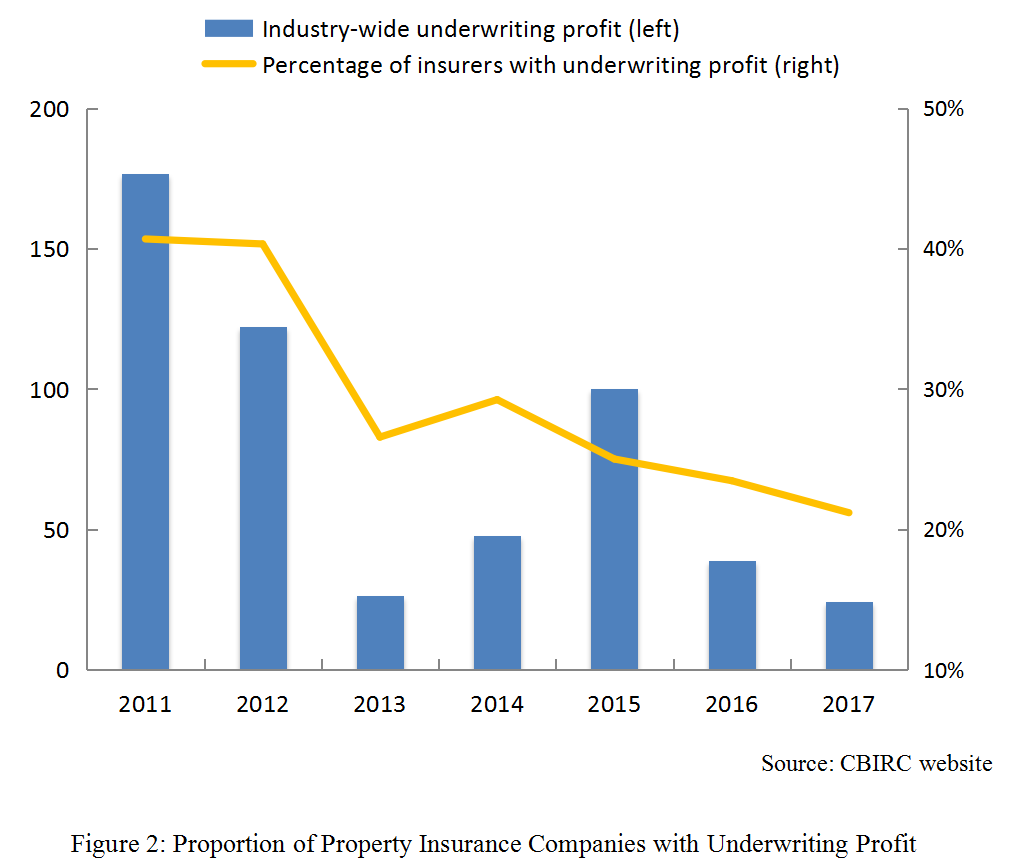

3. Property insurance companies are under considerable operating pressures. In 2017, nearly 80% of property insurance companies were operating at a loss in the underwriting business. In the auto insurance segment, fierce market competition and high expense ratio continue to be the norm, as nearly nine out of ten companies have a combined auto insurance expense ratio of over 40%. High cost makes it difficult for small- and medium-sized insurers to return to profitability and frequently thwarts their differentiation strategy. In the non-auto insurance segment, premium income increased rapidly, hitting a growth rate of 24.21% which exceeded that of the auto insurance segment for the first time since 2013; however, underwriting loss continues to worsen and operational issues were prevalent. Other issues include falling fee rates on traditional non-auto insurance products, rising guarantee insurance risks, and departure of certain accident insurance products from the fundamental purpose of insurance products.

4. Capacity for managing assets and liabilities is being tested by interest rate risk. Interest rate fluctuation has considerable impact on both the assets and liabilities of insurance companies. On the one hand, the increasingly volatile interest rate market makes it harder for insurers to invest in fixed income assets; and when interest rate trends downward in the future, insurers’ investment will be exposed to substantial reinvestment risks. On the other hand, strong market competition has been buoying the cost of policies, the pressure from which will skew the risk appetite of insurers, forcing them to invest in equity assets and lower-rated bonds, increasing both market risk and credit risk.

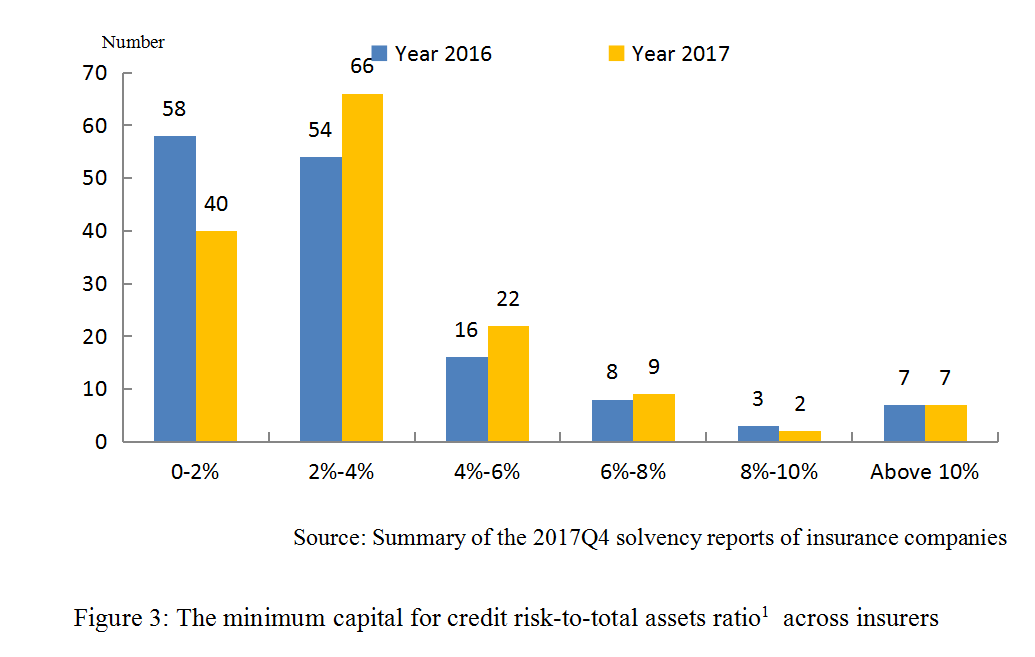

5. The industry should closely monitor credit risks. First, the increasing occurrence of issuer downgrading and default in the bond market and expanding range of risky enterprises and defaulting bonds means investing insurance assets in bonds will incur increased credit risk. Second, the growing share of non-standard investment assets in insurers’ portfolio also increases their exposure to credit risks. For one, mounting local government debt risks have pushed up the potential credit risk of such non-standard investment products as trust and debt investment schemes; furthermore, some non-standard products also harbor default risk themselves, meaning that the credit risks of even relatively sound insurance debt schemes should also be monitored.

6. Insurers are affected by many corporate governance and compliance issues. First there is the weak corporate governance. Some companies are beset by significant risks relating to shareholders’ equity, ineffective corporate governance, prominent risks of related party transactions, and missing internal controls. The second problem relates to rampant compliance issues. In 2017, regulatory authorities had imposed fines of RMB 13.57 million, which is unprecedented in the history of administrative penalty in China’s insurance industry. Majority of the offenses caught were fraudulent telephone sales pitches targeting policyholders. The third problem concerns distorted operating data, most common in the auto and agricultural insurance segments. Some of the distortion is caused by inconsistent statistical standards.

7. Reputation risk cannot be ignored. First there is the case of Xiang Junbo, who has gravely tarnished the image of insurance supervisors. Second, cases where lawbreakers posed as insurance institutions have disrupted market order and eroded credibility of the industry. Third, the number of sales and claims disputes remains high, hinting that greater efforts are needed on the protection of insurance consumers. Fourth, there is a sharp increase in the number of complaints filed by internet insurance consumers and against innovative insurance products, complicating the range of reputation risks faced by the industry.

(3) Expert perspectives

Members of CISFC’s expert committees penned eight observation articles for the report, detailing their thoughts and research on issues such as the operating loss of non-auto insurance segment, commercial auto insurance reform, interest rate risk, transformation of life insurance companies, credit risks, and valuation of long-term equity investments, followed by their recommendations.

The experts offered a full analysis and forecast of the risks facing the insurance industry in 2018, along with their suggestions. They believe that in the long run, insurers still need to guard against the risk of low long-term interest rates. Compared with 2017, the risk-free rate is trending downward in 2018 and there is a shortage of high-yield investment opportunities in the market. Because life insurance companies tend to have long-term, high-cost, and persistent liabilities, they will face reinvestment risks once existing investments mature.

Observing that transitioning and developing bank-affiliated life insurance companies are encountering such issues as high strategic homogeneity, difficult capital replenishment, stunted business structure adjustment, and over-reliance on the parent bank for sales, the experts have proposed suggestions in the area of implementing differentiation strategy, building a market-driven, multi-dimensional capital replenishment mechanism, re-organizing corporate business structures, and creating synergy with group companies.

Regarding the non-auto insurance segment, the experts suggest that, at the regulatory level, the industry should implement a classification-based supervisory regime, promote the implementation of compulsory insurance, strengthen product supervision, and enhance the transparency of fees; at the market level, the industry should enhance risk management training, regularly revise the pure risk loss rate statement, provision for catastrophe reserve, and strictly control intermediary fees; and at the market entity level, market participants should adhere to sound development strategies, operating philosophy, and performance evaluation principles. In addition, the reform of commercial auto insurance should be carried out from the two angles, namely product diversification and rate marketization.

The experts believe that the overall credit risk confronting insurance funds invested in bonds and non-standard products has been rising since 2017, a situation that is not adequately addressed by external rating-based credit risk management systems. Accordingly, when managing credit risks, insurers should adhere to C-ROSS requirements and ensure no fundamental principle is breached. They should also establish an internal credit rating system, achieve the real-time, multi-angle management of risks, apply big data and AI technologies, and develop contingency plans for major incidents. While asset-liability mismatch has been a persistent problem for the industry, the Supervisory Rules for Insurance Asset-Liability Management (No. 1 to 5) released by industry supervisor in 2018 should help address that.